Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. We provide third-party links as a convenience and for informational purposes only. Readers should verify statements before relying on them.

Online invoice factoring free#

does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Accordingly, the information provided should not be relied upon as a substitute for independent research. does not have any responsibility for updating or revising any information presented herein.

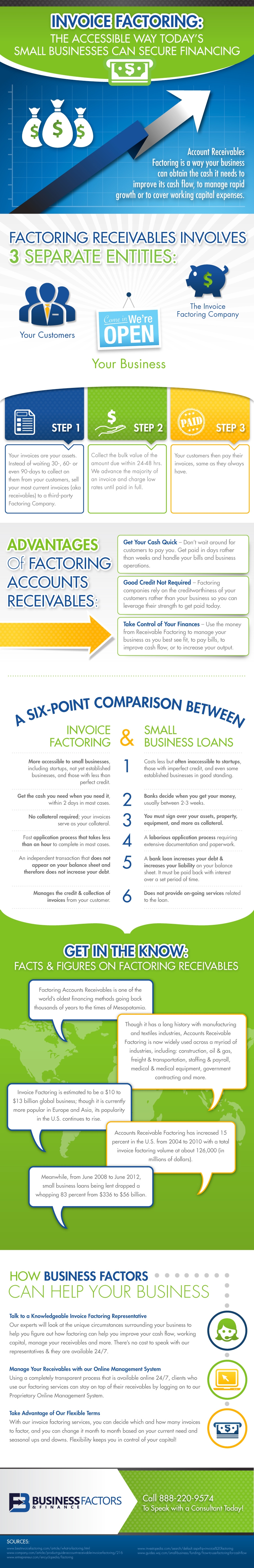

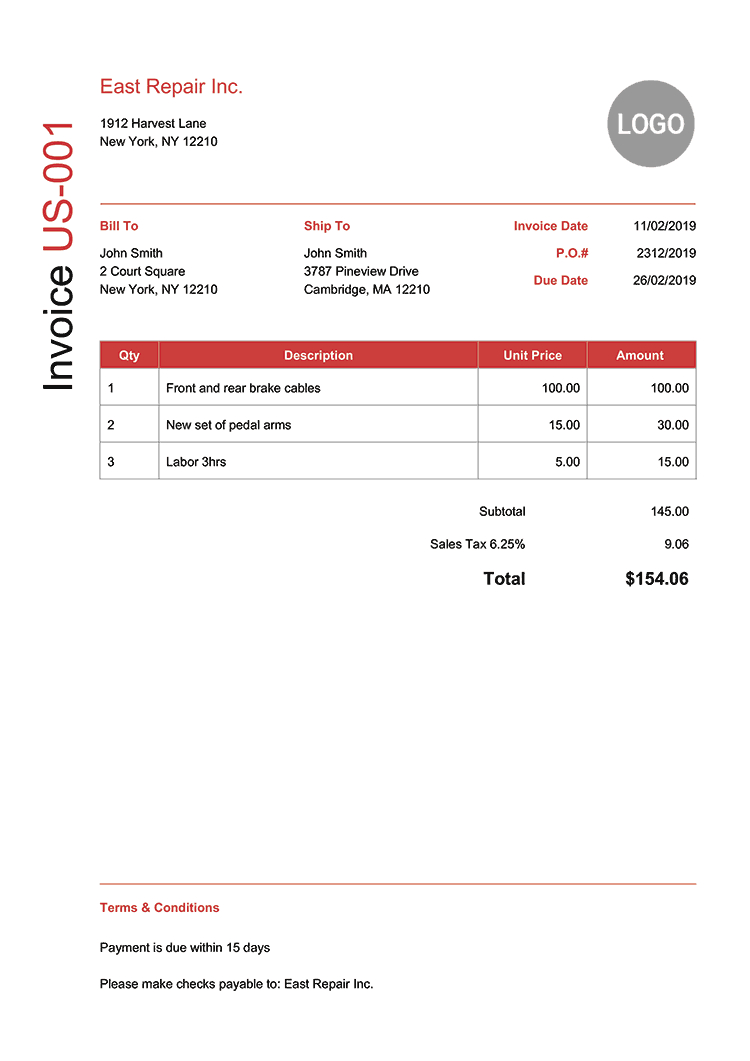

No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Applicable laws may vary by state or locality. Additional information and exceptions may apply. This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. Let’s take a closer look at some of the benefits and drawbacks to consider before moving forward with invoice factoring. Like any financing decision, there are several pros and cons associated with invoice factoring. Invoice factoring is an unsecured method of financing, which means that, unlike a bank lender, an invoice factoring company does not collect collateral.That’s because your customers are the ones responsible for repaying the debt, not you. Invoice factoring companies look at your customer’s creditworthiness more closely than your own.There are a few other differences to note when comparing traditional bank loans and invoice factoring: As mentioned, you’ll receive the remaining balance of your invoice factoring agreement upon customer payment. Within 30 to 90 days, they’ll earn the money back when they collect payment from your customers. Rather than lending you money with the expectation that you repay the loan, an invoicing factoring company buys up a batch of your invoices in exchange for cash. Like a loan, invoice factoring does grant you access to capital you don’t have at the moment, but it’s not technically considered a loan. After they’ve collected all payment for the invoices, they’ll send you the remaining balance. Cash advance rates are generally around 85%. Typically, these vendors will initiate a cash advance for a portion of the total purchase within a few business days. You agree to the terms, so the invoice factoring company says they’ll pay you a total of $24,000 for the invoices. The company says they’ll form an invoice factoring agreement with you and buy your accounts receivable for the value of the invoices minus a factoring fee of 4%. You decide to sell your accounts receivable to an invoice factoring company. Rather than reaching out to a traditional bank for a loan, you decide to take a look at your accounts receivable.Īfter some investigation, you find that you have $25,000 in outstanding invoices.

Let’s say your small business needs $20,000 to replace some necessary equipment, but you don’t have the working capital to do so. A few quick questions can determine if this process makes sense for you.Invoice factoring leverages a small business’s outstanding invoices by turning them into cash. How does invoice factoring work?įactoring is an excellent and straightforward way to finance your business. It takes fewer than ten minutes to apply online.

Online invoice factoring full#

Invoice sellers keep 100% ownership until all debts have been paid off completely – at which time they may decide whether or not to make them available again through another sale / purchase agreement. With you need to what invoice financing is a third party to these businesses in full value customer. The debtor has no control over what happens next. Invoice factoring doesn’t allow this because it involves selling an asset instead. It’s different than any other form of alternative finance, like bank loans that can have negative impacts on credit scores. Invoice financing is a process where you sell your outstanding invoices to a third party in exchange for cash upfront. 25 Great company and great guys that helped me.

19 HOW INVOICE FACTORING CAN IMPROVE CASH FLOW FORECASTING.18 Easier and faster approval than traditional bank lending.17 Immediate access to cash for your business.14 Why Consider A Business Line Of Credit?.13 4 months most recent business bank statements.11 Some information about your business.

0 kommentar(er)

0 kommentar(er)